RBA’s Rate Unchanged: What It Means for Your Home Loan

RBA holds rates for the third time in a row

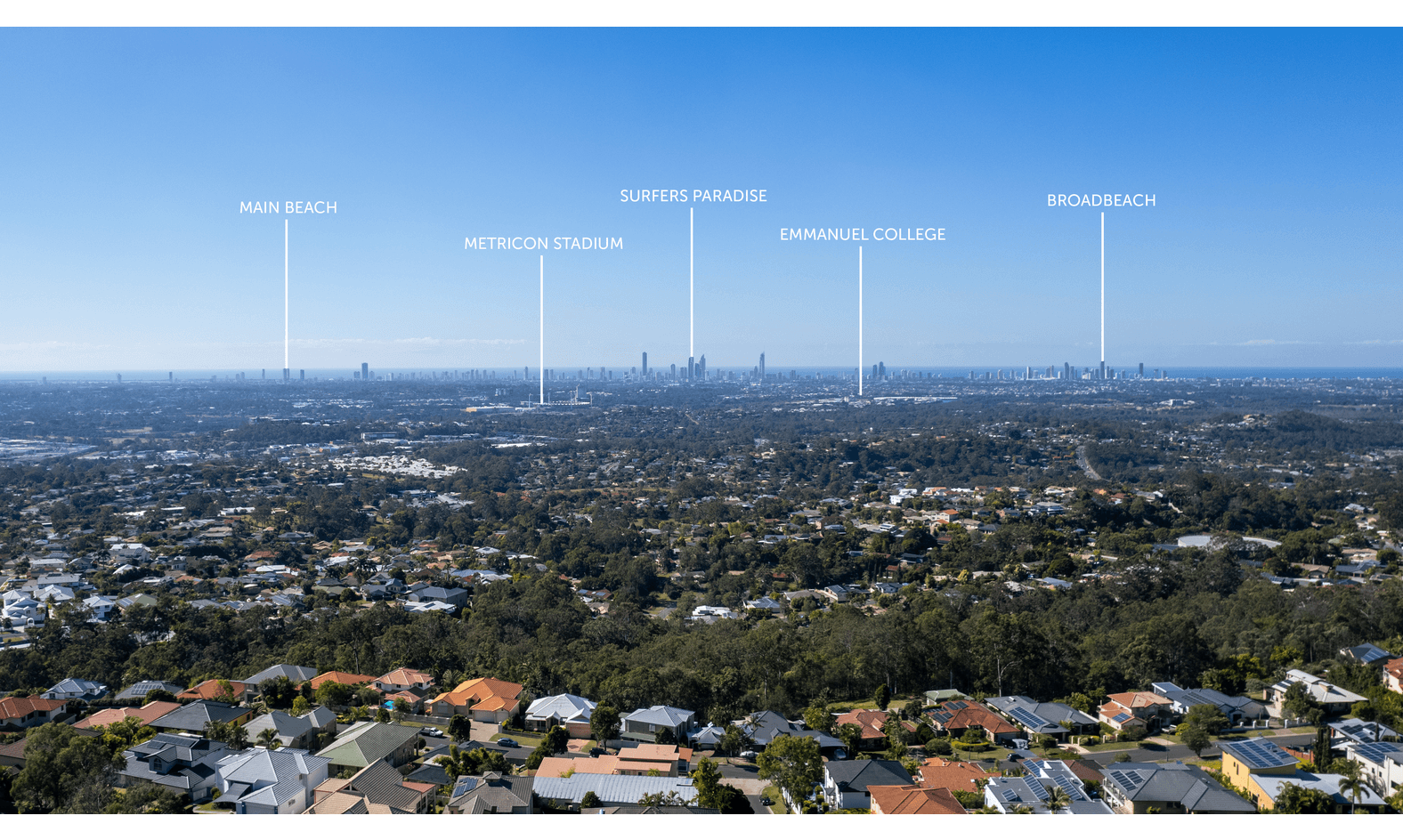

March 19, 2024Highland Park, QLD: A Suburb in the Spotlight

December 23, 2024

The Reserve Bank of Australia (RBA) has decided to leave the cash rate at 4.35% and the interest rate on Exchange Settlement balances at 4.25%. This decision shows the RBA’s focus on controlling inflation while supporting the economy.

For homeowners and families with mortgages, this means no immediate change to interest rates, with the RBA leaving the door open for a rate cut in early 2025 with their dovish commentary. However, understanding the reasons behind this decision is important for planning your finances.

Inflation Still Too High

Inflation, which measures how quickly prices are rising, has come down since its peak in 2022 but remains higher than the RBA’s goal. The target is 2.5%, but inflation is currently at 3.5% in underlying terms (taking out obscure items). This shows the economy is still adjusting, and the RBA’s policies aim to gradually bring inflation under control but are currently working against government monetary policy.

The RBA expects inflation to return to its target by 2026. While this may seem far away, it highlights the need to keep financial plans flexible to handle potential changes.

Economic Growth Is Slowing

Australia’s economy is growing, but only slightly. Over the past year, the economy grew by 0.8%, which is the slowest pace of growth in decades, apart from during the COVID-19 pandemic (in real terms the economy is in a GDP-per-capital recession and has been for multiple quarters). Many households are feeling this slowdown, with spending on non-essential items decreasing due to higher living costs and tighter budgets.

What About Jobs and Wages?

The unemployment rate is now 4.1%, up from 3.5% last year. While this shows a slight weakening in the job market, employment levels remain strong driven by public job growth, and job vacancies are still relatively high. Wages are growing, but at a slower pace, which can make it harder for households to manage rising expenses.

What This Means for Your Mortgage

The RBA’s decision to hold the cash rate steady is mixed news for borrowers in the short term, as mortgage repayments are unlikely to increase right now – but the rate cut before Christmas did not eventuate.

At hfinance, we specialize in helping homeowners and buyers navigate these uncertain times. If you are concerned about rising costs or want to explore ways to make your mortgage more manageable, we are here to help.

How hfinance Can Support You

We work with over 30 lenders, including all major banks, to find the best loan options for your situation. Whether you are looking to refinance for a better rate or understand how the cash rate affects your repayments, we provide simple, clear advice tailored to your financial goals.

Stay Ahead with hfinance

The RBA’s focus is on controlling inflation while supporting the economy. At hfinance, we are committed to helping you stay informed and prepared.

Contact us today to review your home loan or explore how you can manage your finances more effectively. Follow us for more updates and tips to make the most of your financial future.