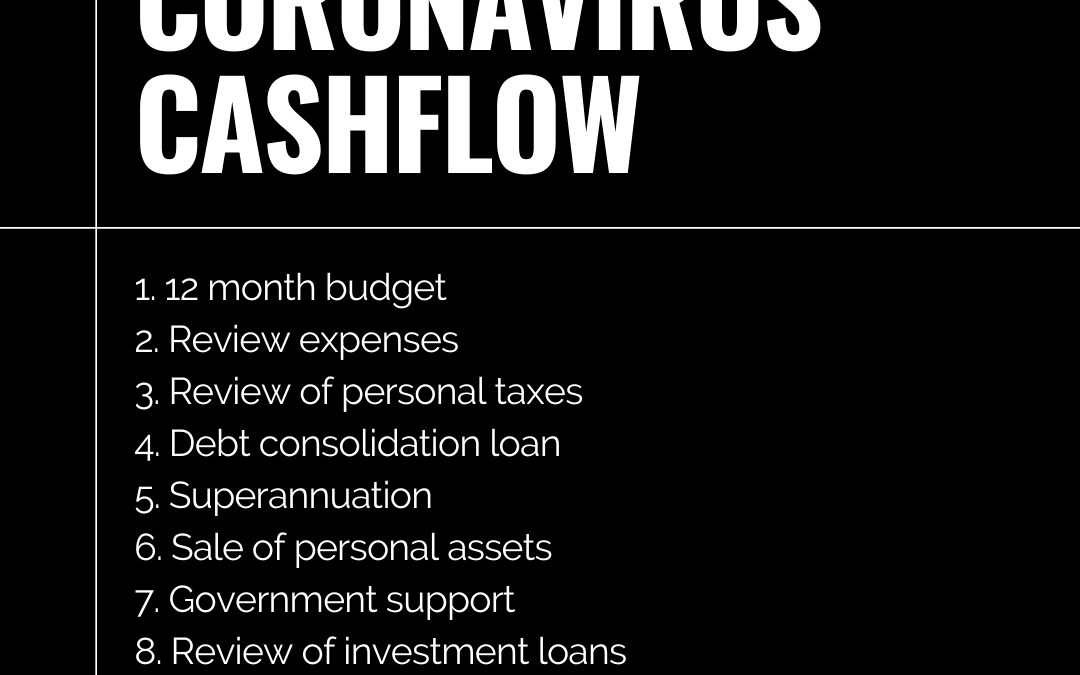

Coronavirus Cashflow Checklist

Coronavirus family budget

March 21, 2020

RBA Cash Decision September 2020

September 2, 2020We are all navigating, what can be described as uncertain times. We cannot control these external factors, but what we can control is our family’s finances through budgeting and maximising your cashflow over this period of uncertainty.

To help during this period, we have put together a cashflow checklist, for yourself and your family to follow for the next 6 to 12 months.

We hope you can find value in this checklist as you apply these action items.

Important to note: this is general advice and does not take in account your personal circumstances.

12 month budget and cash-flow spreadsheet

You can download our FREE CASHFLOW FAMILY BUDGET HERE.

Once you download the spreadsheet. Here is how you complete the cashflow family budget.

- Use the cover page tab to input your data on the Asset and Liability section. This will allow 1 or 2 person information and will sum the figures. Important to split out the assets to breakdown the liquid assets.

- Go to the monthly budget tab. Work out your income and expenses. I recommend you download the last 3 months of your banking data (use this link to follow how-to download to CSV file and pivot) and input into the yellow cells, this should be done for all banking and credit card statements and buy now pay later facilities. The yellow cell will extrapolate the period (for example if you have a fortnightly expense – it will work out the month expense)

- This will then work out the 12-month cashflow income and expense movements.

- There is a formula down the bottom to work out cash reserves and the next 6 months’ expenses required.

- If the amount is negative, you will need to adjust on the expense side to close that gap or increase the cash liquid balance.

Review of expenses

We highly advise you review your expenses for the last three months. This can be achieved by downloading your banking data (savings, cheque, credit card accounts).

Once you have downloaded the data, you can pivot the data and go through the expenses and direct debits, click on this link for a step by step video on how to pivot your banking data.

What expenses can you cancel today and go without? Look at any discretionary items which may include;

- Gym memberships

- Donations

- Paid subscription services (Netflix, Amazon, Spotify, iTunes)

- Memberships for recreation and sporting clubs

- Food delivery

Remember that this a temporary arrangement for the next 6 to 12 months.

Look at upcoming reoccurring bills such as council rates, insurance or car registration. See if there is an option to pay over monthly or quarterly instalment, rather than an annual lump sum. This will smooth cashflows, if the company does not offer this service, consider switching with competitors. For example, most home and contents insurance companies will offer a monthly payment options.

Set up direct debit payments for essential utilities only (electricity, gas, water). Did you know that our utility accounts can be prepaid before their due date? As utility bills are issued quarterly, customers may make monthly prepayments into individual accounts via BPAY to smooth out the bill shock. Look at your last invoice to get an idea of monthly expenses.

Review of personal taxes

Have you lodged your 2019 income tax return? Speak with your accountant to ensure you have claimed the appropriate deductions on your tax return. If you are expecting a refund, lodge your tax return as soon as possible, to get your hand on the tax refund.

Similarly, talk with your accountant on any pre-paid tax you have made to the ATO. Are you entitled to getting these credits back, can you vary down your PAYG installment?

Important to note: this is not tax advice and does not take in account your personal circumstances. Please speak with a tax agent.

Debt consolidation loan

If you have a home mortgage and some personal debt, you can consolidate the payment into a new loan and reduce your monthly repayment. Let’s use the following example

Home mortgage – $400,000 balance, paying principal and interest, 3% loan with 20 year loan term remaining = monthly repayments of $2,218 per month

Car Loan – $15,000 balance, paying principal and interest with 24 months loan term remaining, 4.15%, zero balloon = $652 per month repayment

Credit card – $2,000 carry forward balance, 18% interest, to pay off over 2 years = $98 per month

Total monthly repayments of = $2,968 per month

A debt consolidation loan, would consolidation the three facilities into one loan and reset the mortgage loan, potentially up to 30 years. IMPORTANT TO NOTE THAT IF THE LOAN IS PAID OFF OVER 30 YEARS YOU WILL PAY MORE INTEREST.

But this scenario of rolling into a new loan of $417,000, 30 year loan at 3% interest = monthly principal and interest repayment of $1,758 per month.

Total monthly cashflow repayment saving of = $1,210 per month or a 41% decrease in monthly cashflow repayments.

This could be a suitable solution as a short cashflow solution and 12 months later, increase the repayments to pay down the loan over 15-20 years to ensure you do not pay additional interest.

A residential refinance generally costs $750, but many lenders are offering cash back of $2k – $4k, which would also provide additional cashflow relief.

A debt consolidation can also work for individuals, who do not have home loan, but have multiple unsecured credit facilities.

For example 2 credit cards and a car loan, can be consolidated into a person loan term over 7 years.

Credit card – $4,000 balance, 18% interest, repayment over 2 years = $197 per month

Credit card – $13,000 balance, 18% interest, repayment over 2 years = $639 per month

Car loan – $10,000 balance, 4.15% interest, repayment over 3 years = $444 per month

Total monthly repayments of = $1,280 per month

Consolidate the repayments into a personal loan $27,000, 8% interest rate, repayment over 7 years = $421 per month repayment

Represents a $859 cash flow saving per month or 67% reduction in repayments per month.

Superannuation

If you are currently salary sacrificing into your superannuation account from your pre-tax earnings. Speak with your financial advisor about reducing or stopping this pre-tax deduction to see what post-tax, the cash-flow impact this will have.

This can provide additional cash-flow in the short term, as it increases your take home pay.

You can also look at accessing superannuation under hardship, you can READ MORE HERE, but also speak with your financial advisor on the options available for you.

Important to note: this is not financial advice and does not take into account your personal circumstances. Please speak with a financial advisor.

Sale of personal assets

If you are stuck in home, now is the time to go through items you don’t use and turn into additional cash. Think about some of the items that would be in great demand.

Computer game systems, books, furniture, children’s games, arts and craft and electronics. Use the time to advertise online and drop off to new buyers, to turn those unused items into cash.

Understand the government support available

The government has released a series of measures to support Australians. These measures are being updated continuously by the government. You can read more on the federal programs available – using this link to READ MORE.

Review of investment loans

If you currently have an investment home loan, you have a couple of options available.

In the last 12 months we have seen the RBA cut the central cash rate from 1.5% to .25%. This represents nearly 100 points passed onto borrowers. If you maintained the monthly repayments and did not’ ‘adjust’ down you monthly repayment to represent the lower interest rate. You would be building a balance in your redraw account. If you want you can access and draw down on the redraw facility to access cash.

The other option, is refinancing the home loan from principal and interest into interest only repayments.

For example, $400,000 investment home loan, 3.2% interest rate, principal and interest repayments with 20 years left on the loan term. Monthly repayments of $2,269

If you were to refinance into 30 year loan, with a 5 year interest only period and then 25 years principal and interest repayments.

$400,000, 3.5% interest rate, 5 year interest only, with a 30 year loan term. Interest only repayments of $1,177 per month

This represents a $1,092 cash flow saving per month or 48% cashflow saving.

Reviewing financial hardship

If you are facing financial hardship, the Australian banks have hardship teams that can support. They can assist in the following ways:

- A deferral of scheduled loan repayments

- Waiving fees and charges

- Debt consolidation to help make repayments more manageable.

To read the of the bank’s hardship teams and their contact details, use this LINK TO READ MORE.

If you would like to discuss your situation in detail. You can book a call with Jeremy, using THIS LINK. Understanding that this can be a stressful period, all calls are confidential and complimentary.